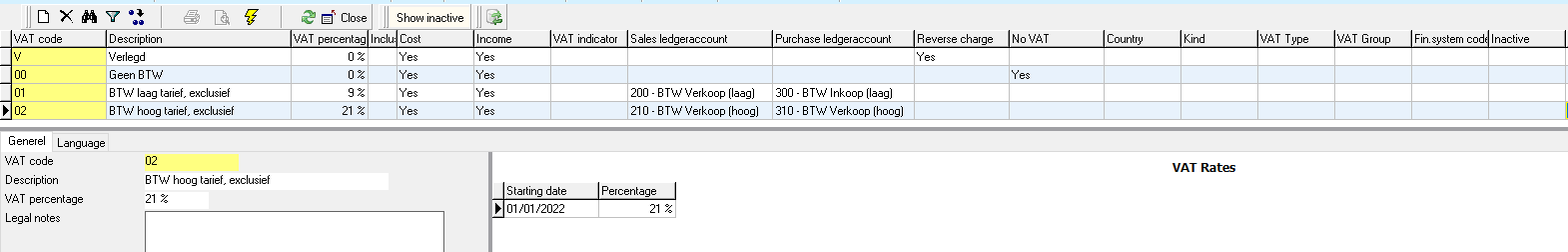

In Transpas, the VAT codes that are used can be entered in the VAT codes screen.

This can be opened via:

- Main files -> Financial -> VAT -> VAT codes

- F11 -> VAT codes

¶ Create VAT codes

Preferably, the VAT codes are imported from the financial package.

This normally happens during the implementation of Transpas.

If the link with the financial package has been established, this can be done with the action Import VAT codes:

The VAT codes can also be created manually. In that case, enter at least the VAT code and a logical description.

¶ Change VAT code

If a VAT code changes (for example due to a change in the law), this can be entered at the bottom right of the screen under VAT rates:

Here you can enter the start date and the new percentage.

The start date is based on the financial date of a shipment.

The fields Sales ledger account and Purchase ledger account can also be filled in. These are set to invisible by default. Contact us contact if they need to be made visible.

¶ Explanation of fields

| VAT code | The VAT code |

| Description | A description of this VAT code (e.g. VAT High 21%) |

| VAT percentage | The actual percentage |

| Fin. system code | If the financial system uses its own codes, this can be entered here |

| Costs | If this is a VAT code that is used for costs, set it to yes |

| Revenue | If this is a VAT code that is used for revenue, set it to yes |

| Sales ledger | A fixed general ledger account for this VAT code can be entered here |

| Purchase ledger | A fixed general ledger account can be entered here for this VAT code |

| Transferred | Enter yes here if this is transferred VAT. This is used in reports |

| No VAT | Enter yes here if this is 0% VAT. This is used in reports |

| Inclusive | If this VAT code is inclusive, enter yes here |

| Indicator | If the financial package asks for an indicator, you can enter it here |

| Country | This allows you to limit the VAT code to 1 country |

| Type | This allows you to enter: high, low, shifted, non-EU 0% or medium This does not affect the percentage/amount |

| VAT type | Some financial packages ask you to indicate the VAT type |

| VAT group | Some financial packages ask you to indicate the VAT group |

| Inactive | This allows you to set a VAT code to inactive |

Also see: