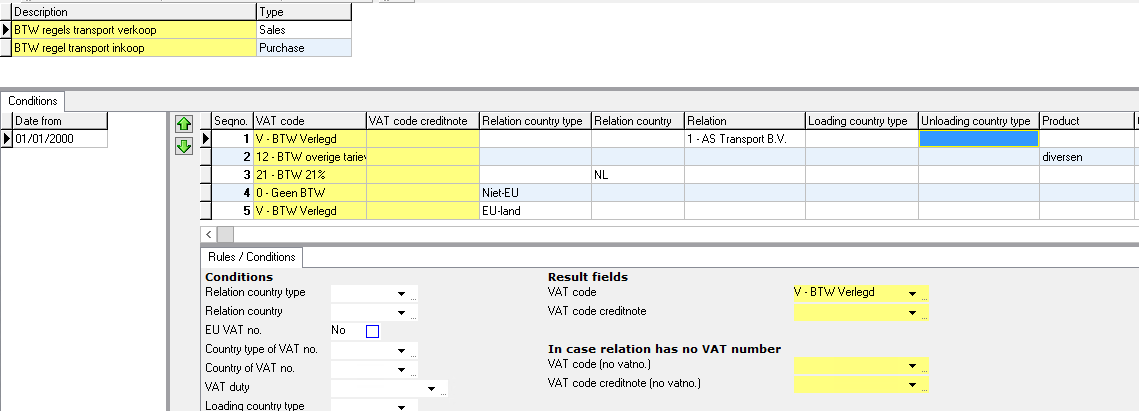

In the screen VAT rules you set which VAT code is to be filled in on a shipment.

For your information: it is not possible to manually change the VAT code on a shipment.

Open the screen through

- Main files -> Financial -> VAT -> VAT rules or

- F11 -> VAT rules

The VAT rules are applied each time a shipment is changed.

Transpas will check each rule from top to bottom. The VAT code filled in on this line is set on the shipment.

Moving rules

Using the two green arrows rules can be moved up or down. It is useful to place rules with more conditions higher up.

Desciption / Type

In the top left the type can be filled in. Type can be sales or purchase.

Date from

Here you can set when these VAT rules should apply. It is possible to make multiple sets of VAT rules.

Rules/conditions

Next you have to make the different sets of rules.

The fields with a yellow background are filled in, the other fields are rules/conditions.

A VAT code can be filled in. Per line you can also set which VAT code should be used for a credit note (when this is empty, a credit note uses the same VAT code).

In the screenshot above for instance it is stated that:

- When the customer is 1 - AS Transport, VAT code V - BTW verlegd is filled in

- When the product is diversen, VAT code 12 - BTW overige tarieven is filled in

- When the customer is from the Netherlands, VAT code 21 - BTW 21% is filled in

- When the customer is not located in an EU-country, VAT code 0 - Geen BTW is filled in

- When the customer is located in an EU-country, VAT code V - BTW verlegd is filled in

There is a large number of possibilities for setting VAT rules.

Remember that Transpas checks from top to bottom and chooses the first rule whose conditions match.

When the product is diversen (rule 2) the country type (rules 3 - 5) don't matter, because rule 2 already has been applied.

¶ Country type

Relation country type can be inland, EU or non-EU.

In the screen Countries you can set what type each country has.

¶ Catch rule

It is possible to set a rule without conditions in the last place.

The VAT code that is set here, will be filled in on a shipment which doesn't apply to any other rule.

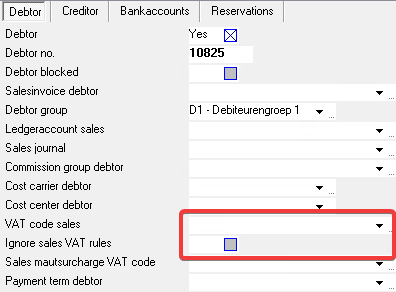

¶ Exception on the level of a relation

In the screen Financial relations an exception can be made per relation for the VAT rules.

Advised is to not do this, but to make a VAT rule where this relation is filled in and put this in the top (like done above with 1 - AS Transport). This way all VAT rules are in one screen.

Making an exception op relational level is done by filling in the VAT code sales and checking the box for ignore sales VAT rules:

¶ Company screen

In the company screen the default VAT code for sales and purchase can be filled in.

This is also not recommended, it is easier to use a catch rule so the rules are all in one place.

You can find these under General -> Company data -> Sales VAT code / Purchase VAT code.

Also see: