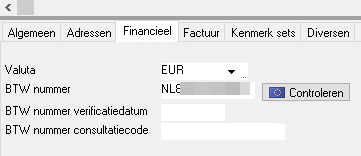

In the Financial Relations screen you can enter the VAT number under the Financial tab.

In Transpas it is possible to check the VAT number via the button with the EU flag and the word 'Check':

This check is done via the site https://ec.europa.eu/taxation_customs/vies/vatRequest.html

Because this is an EU service, this check is only possible for EU member states.

Checking the VAT number for a British customer is not possible and will have to be done at the UK Tax Administration.

¶ Error messages

¶ Invalid_requester_info

Error validating VAT number: "NLxxxxxxxxxxxx"

Through the web service of the European Commission

http://ec.europa.eu/taxation_customs/vies/vieshome.do

Error code: INVALID_REQUESTER_INFO

This error message means that the applicant's VAT number is incorrect. Check your own VAT number in the Companies -> General screen.

¶ Ms_max_concurrent_req

Error validating VAT number: "DExxxxxxxxxxxx"

Error code: MS_MAX_CONCURRENT_REQ

Source: http://ec.europa.eu/taxation_customs/vies

This error message means that too many validation requests are received at the same time for the same country at the European Commission's verification API.

This is about the number of requests from everyone who uses this verification API.

If you try multiple times, the validation may sometimes succeed. It may also work better early in the morning, late in the afternoon or in the evening, when fewer people are working and need to validate VAT numbers.

Transpas cannot do anything about this. If you receive this message, there is nothing you can do but try again more often or later, until the verification works.